What is Algorithmic Trading?

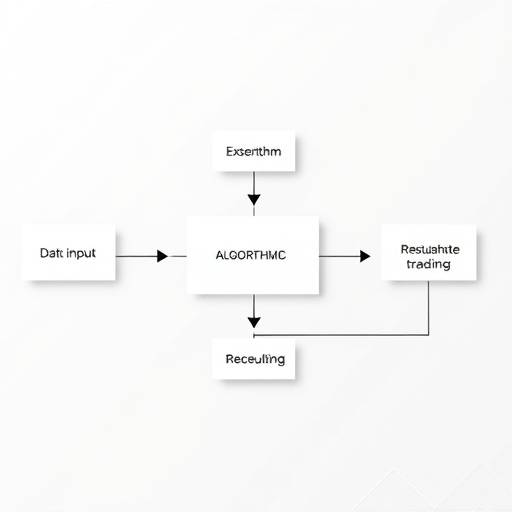

Algorithmic trading, also known as automated trading, black-box trading, or algo-trading, involves using computer programs to execute trades based on a pre-defined set of instructions. These instructions can be based on factors like price, time, volume, and other market indicators. The goal of algorithmic trading is to capitalize on market inefficiencies and execute orders faster and more efficiently than human traders.

Imagine a scenario where a trader wants to buy 100 shares of Qtrade Corp. when its price drops to $50. Instead of manually monitoring the stock price and placing the order, they can program an algorithm to automatically execute the trade as soon as the condition is met. This is a basic example, but algorithms can be much more complex, incorporating numerous variables and strategies.

Key Components of Algorithmic Trading Systems

- Algorithms: The core of the system, defining the trading strategy and rules.

- Trading Platform: Software that connects the algorithm to the market exchange for order execution.

- Market Data: Real-time or historical data used by the algorithm to make trading decisions.

- Infrastructure: Hardware and network infrastructure required for reliable and fast order execution.

Benefits of Algorithmic Trading

Algorithmic trading offers several advantages over traditional manual trading methods:

- Speed and Efficiency: Algorithms can execute trades much faster than humans, capitalizing on fleeting market opportunities.

- Reduced Emotional Bias: Trading decisions are based on predefined rules, eliminating emotional factors that can lead to errors.

- Backtesting: Algorithms can be tested on historical data to evaluate their performance and optimize their strategies.

- Improved Order Execution: Algorithms can optimize order placement to minimize market impact and slippage.

- 24/7 Trading: Algorithms can operate continuously, even when human traders are unavailable.

- Diversification: Allows managing multiple portfolios and strategies simultaneously.

According to a study by the Trading Technologies Institute, algorithmic trading accounts for a significant portion of trading volume in major financial markets. "The adoption of algorithmic trading has revolutionized the financial industry, providing increased efficiency and liquidity," says Dr. Eleanor Vance, Professor of Financial Engineering at the University of Toronto.

Risks of Algorithmic Trading

While algorithmic trading offers many benefits, it also comes with certain risks:

- Technical Glitches: Errors in the algorithm's code or failures in the trading infrastructure can lead to unintended trades and financial losses.

- Over-Optimization: Algorithms that are too tightly optimized to historical data may perform poorly in live trading environments.

- Market Volatility: Sudden market movements can trigger unexpected behavior in algorithms, leading to significant losses.

- Regulatory Risks: Algorithmic trading is subject to regulatory scrutiny, and changes in regulations can impact trading strategies.

- "Flash Crashes": While rare, poorly designed algorithms can contribute to rapid and destabilizing market events.

It's crucial to have robust risk management systems in place to monitor and control algorithmic trading activities. These systems should include mechanisms for detecting and preventing errors, as well as procedures for handling unexpected market events.

Qtrade's Approach to Algorithmic Trading

At Qtrade, we understand the potential of algorithmic trading, and we are committed to providing our clients with the tools and resources they need to succeed. Our approach to algorithmic trading focuses on:

- Robust Technology: We offer a state-of-the-art trading platform with reliable infrastructure and advanced order execution capabilities.

- Risk Management: We have implemented comprehensive risk management systems to monitor and control algorithmic trading activities.

- Education and Support: We provide our clients with educational resources and expert support to help them develop and implement effective trading strategies.

- Compliance: We adhere to all applicable regulations and industry best practices.

Our dedicated team of quants and developers, led by Senior Algorithmic Strategist, Arthur Pembroke, are constantly working to improve our platform and provide our clients with the latest advancements in algorithmic trading technology. We believe that by combining cutting-edge technology with sound risk management principles, we can help our clients achieve their trading goals.

Qtrade's algorithmic solutions are designed to empower traders of all levels, from beginners exploring automated strategies to seasoned professionals seeking to optimize their execution. We offer a range of pre-built algorithms and customization options to cater to diverse trading styles and risk appetites.

Conclusion

Algorithmic trading is a powerful tool that can provide significant advantages in today's fast-paced financial markets. However, it's important to understand the risks involved and to implement appropriate risk management controls. With the right technology, education, and support, algorithmic trading can be a valuable asset for any trader.

"Algorithmic trading is not a replacement for human judgment, but rather a tool that can enhance it. It's about combining the power of computers with the insights of experienced traders." - Arthur Pembroke, Senior Algorithmic Strategist, Qtrade.